Norwegian hat in einer internen Präsentation den weiteren Fahrplan vorgestellt …

Norwegian ist schon längere Zeit in einem heftigeren Fahrwasser unterwegs. Mit der Coronakrise hat sich das nochmals verstärkt.

Schon jetzt hat man einzelne Tochtergesellschaften liquidiert und in Insolvenz geschickt: Norwegian in Trouble: Tochterunternehmen in Insolvenz

Die Prognosen für die weitere Zukunft hören sich äußerst apokalyptisch an. Man kann den Verlauf der Pandemie nicht einschätzen. Auch bei einer Restrukturierung würden hohe Schulden bleiben. Es gibt Unsicherheiten die laufenden Verträge für neue Flugzeuge erfüllen zu können. Der Zahlungskreislauf ist gestört. Die Kreditkartenfirmen halten Beträge zurück. Das Spekulieren auf Treibstoffpreise führt zu keiner Kostensenkung aufgrund derzeitiger niedriger Treibstoffkosten. Man hat auf ein höheres Level spekuliert. Der Covid-19 Ausbruch wird zu starken Fluktuationen im Bedarf führen.

Hier die Information an die Teilhaber:

„The Group’s business, operations and financial performance have been adversely impacted by the outbreak of Coronavirus SARS-CoV-2 (COVID-19). In a very short time period, the Group has lost most of its revenues due to global travel restrictions. Given the rapidly evolving landscape of the COVID-19 pandemic, it is impossible to predict the consequences of the COVID-19 for the Group. The Group’s ability to maintain its business and operations in the near term, including its ability to service its debt obligations, is dependent upon a reduction and/or restructuring of a material part of its debt, as well as obtaining access to the State Aid Package. There can be no assurance whether and to what extent the Group will succeed in such debt restructuring or if it will obtain funds under the State Aid Package. There is also a risk that the Company will be unable to satisfy its payments obligations in the medium-term even if it receives the State Aid Package unless further funding is provided.

Even if the Group is able to restructure its debt (including part conversion to shares), it is expected that the Group will still have a significant amount of debt, including substantial fixed obligations under aircraft leases and financings. The Group’s ability to service such debt is subject to a number of risk factors, including the future effects to the Group’s operations caused by the COVID-19 outbreak.

The Group has significant liabilities relating to aircraft acquisitions and may not obtain financing of such acquisitions. A failure to secure financing or to meet payment obligations under aircraft acquisition contracts may lead to a breach of contract. Such default may result in severe financial penalties, and make the Group unable to take delivery of the acquired aircraft.

The conversion of the bonds is, among other things, subject to that the State Aid Package will be available to the Issuer following such conversion. The availability of the State Aid Package is subject to several conditions, and will, among other things, likely require that the Company receives at least NOK 300 million in a Private Placement or Offering. Even if the Company successfully completes such a Private Placement or Offering, such transaction(s) may be completed up to several weeks after the bondholders’ meeting scheduled for 30 April 2020.

The Group’s business can be adversely affected by a number of factors, many of which are outside of the Group’s control, such as technical problems, problems with information technology systems, third party service providers failing to deliver services in a satisfactory manner etc. Such issues may result in delays or cancellation of flights or failure to deliver satisfactory services of the Group’s customers, which in turn may have a material adverse effect on the Group’s business, financial condition, results of operations and future prospects.

A significant part of the Group’s customers pay with credit cards. A portion of the payment is received from the credit card acquirers upon booking and the remaining upon travel. The credit card companies have, due to the Group’s financial situation, increased the hold-back of payments, resulting in a negative impact on the Group’s cash flow over the past quarters. Although the Group now believes to be at a peak level, there is still a risk that the credit card companies may further increase their hold-back with an adverse effect on the Group’s liquidity.

The Group is exposed to volatile aviation fuel prices and exchange rate fluctuations which may affect the Group’s financial condition or results of operations. The Group’s foreign exchange risk mainly arises from fuel and aircraft purchases, aircraft maintenance, aircraft leasing payments and sales revenue denominated in foreign currencies. The largest investments, including the acquisition of aircraft and their spare parts, are also mainly made in USD and EUR. Fuel costs and aircraft leasing costs are also USD-denominated and represented 34 percent of the Group’s operating costs (before aircraft leasing and depreciation) in 2019.

The Group is actively using derivative instruments to hedge fuel costs, interest rates and currency, with the aim of mitigating the volatility of the Group’s financial results caused by market price fluctuations. The market price of the derivatives may decrease substantially, resulting in substantial hedging losses for the Group, as well as leaving the Group unable to participate fully in the economic benefits of the price decrease, which again could impact the Group’s short-term cost effectiveness.

Demand for airline travel and the Group’s business is subject to strong seasonal variations and uncertainty caused by the COVID-19 pandemic. Additionally, the Company is vulnerable to small changes in its revenues by ASK (Available Seat Kilometre) in due to high fixed costs.

The Group may not achieve its goals in future negotiations regarding the terms of collective labour agreements of its unionized work groups, exposing it to the risk of strikes and other work-related disruptions.

The potential issue of new shares in connection with the contemplated debt restructuring and share offering could significantly increase of the number of issued Shares in the Company. Sale of a substantial number of such Shares, or the expectation of such sale, may have a material adverse effect on the trading price of the Company’s shares and the ability for shareholders to sell their shares at attractive terms, in a timely fashion or at all.

The Company is subject to statutory rules requiring the Company and/or its subsidiaries to be owned and controlled by shareholders who are EEA nationals. The Company’s articles of association entitles its Board of Directors to require shareholders that are non-EEA nationals to sell their shares insofar as this is necessary to ensure that the Company no longer violates the above-mentioned provisions regarding ownership and control.

Beneficial owners of the Company’s shares that are registered in a nominee account may not be able to exercise their voting rights.“

Die Präsentation: Norwegian Air Shuttle ASA Presentation to bondholders (PDF)

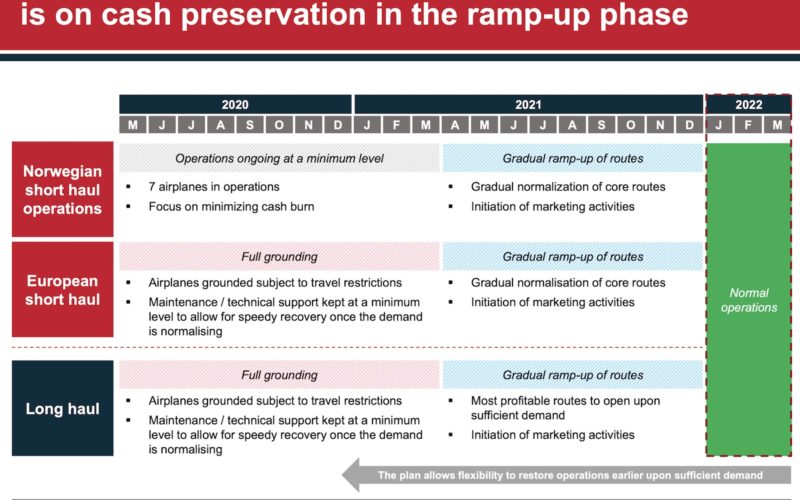

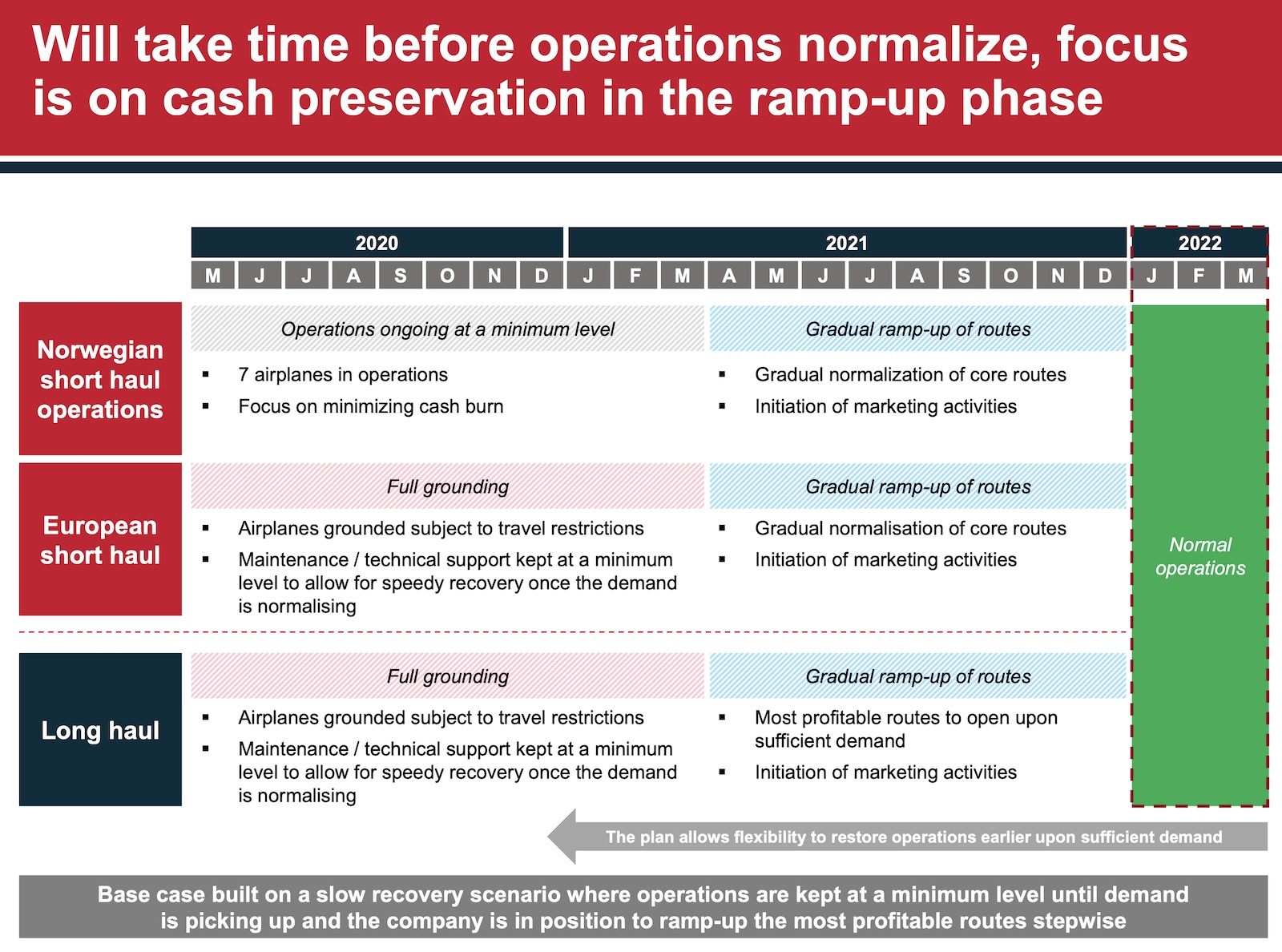

Norwegian versucht nun – so die Graphik oben – durch diese Phase mit wenig Kosten zu überstehen und mit Mitte April 2021 wieder voll ins Geschäft einzusteigen. Haben wir schon mal gesagt, dass dieser Sommer möglicherweise nichts wird, so sagt uns Norwegian gerade, dass auch Weihnachten gestrichen wird. Na hoffen wir für Norwegian alles Gute und auch für uns selbst.

Schau doch in unserer Boardingarea DE Facebook Gruppe vorbei –> Vielfliegerlounge

Ach Du *********. Wenn das alle so sehen, na dann Prost Mahlzeit ;(

Austrian aiines braucht eh gute a350, wie man so munkelt wartet Lh nur drauf zuzuschnappen…

Die sollten wir dann wenigstens mit Österreich Bezug benennen ;)

Austrian Airlines bekommt in absehbarer Zeit leider weder A350 noch sonstige neue Flugzeuge

Ich sehe eher, dass LH die schon bestellten 787 an Austrian verteilt. Zum einen sind die ein bisschen kleiner als der A350, zum anderen ist Austrian sowieso schon Boeing-Betreiber auf Langstrecke (767 und 777). Damit sind die Umschulungskosten fuer Piloten und Wartungspersonal deutlich geringer.